Many of the suburban areas in Japan still accept cash and look like Japan still has an image of lagging behind in the use of cashless payment compared to other countries. However, from the most convenient IC cards used for not just commuting but also for payment to Apple Pay to PayPay to even more, there are different forms of cashless payment which are widely accepted in Japan. This article will take you through a detailed information about the situation of cashless payments in Japan.

-

01

Digital Payment Methods

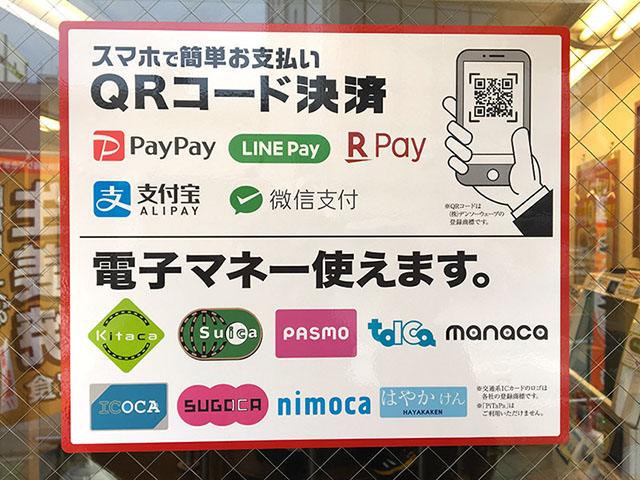

Newer cashless methods such as virtual commuter passes and QR codes are being accepted at over a million stores in Japan. While there are slight differences, such logos of PayPay, Alipay, LINE Pay, R Pay, and other IC cards are often placed at the cashier indicating those digital payments are available for use. Targeting more for visitors from Asian regions, these QR-code payment terminals have been installed in large cities and major tourist destinations. Yet, Japan is still far below the global average for cashless payments as the use of the almighty VISA and Mastercard credit cards are still a minority.

![]()

-

02

IC Card

Initially used to swipe into the public transport system, notable cards like SUICA and PASMO have penetrated among many restaurants, cafes, shops, drug stores, supermarkets etc. as a form of payment. Now that these prepaid and rechargeable cards are available not just physically but on Apple Pay and Google Pay, it is not overstating to say that these cards are the king of cashless payment in Japan.

![]() READ MORE

READ MORE- Japan Railway Prepaid IC card - Welcome Suica

-

![]()

- Ticket

READ MORE- Suica and Pasmo: Transportation IC cards and How to Use them in Japan

-

![]()

- Transportation

-

03

Credit Card

Undeniably, the easiest cashless option for both short term visitors and residents is the use of credit cards. This option comes in handy when travelling to major tourist spots in large cities, however, not strongly recommended for those visiting the countryside. Most will accept VISA or Mastercards, however, make sure to keep an eye on the logos at the cashier for the availability.

Using VISA card, cash can be withdrawn from several banks while Mastercard can too.![]() READ MORE

READ MORE- How to Get Cash with An International Card

-

![]()

- Money

-

04

Debit Card

There are two main types of debit cards. One is a card that is affiliated with an international brand. The other is J-Debit, which uses the bank's cash card as a debit card. If the international brand is VISA, the card can only be used at VISA member stores, and if it is J-Debit, the card can only be used at J-Debit member stores. The logos of the participating brands are found at the stores so customers can check them prior to their purchase. Just like credit cards, many stores accept debit cards, however, there are some exceptions like making payments at toll gates on expressways, online services like Netflix, etc.

![]()

-

05

Apple Pay & Google Pay

In Japan, since the launch of Apple Pay and Google Pay with commuter/transportation cards, SUICA and PASMO (only for Apple Pay), this has become one of the most popular forms of payment. While there is a higher chance of visitors to Japan already having this convenient app, visitors would need to keep in mind that only a few retailers that have the NFC Visa/Mastercard/Amex contactless acceptance marks at the payment terminal can use this payment using cards from the visitors’ home country.

![]()

-

06

PayPay

This is a new cashless form of payment operated by Softbank and Yahoo! Japan joint venture. Just like a prepaid card, PayPay is available for smartphone users in Japan with no fees or minimum balance required to open an account. Payment is done by scanning the QR code at the cashier and showing it to the merchant. Either through the bank account, or transfer money via ATM or credit card, PayPay can be recharged.

![]()

-

07

LINE Pay

Of Korean origin, operated by LINE, the company offers digital payment service provided on Line's messaging app platform. Once downloading the app, users can add balance to their account via bank transfer or at convenience stores to use this form of payment. After adding the balance, users can pay by presenting a bar- or QR code on their smartphone screen to the cashier. Only those who have a LINE account with a Japanese phone number registered can use this service. Since 2019, LINE has formed partnerships with Tencent and now LINE Pay membership shops in Japan accept payment with WeChat Pay by Chinese travelers.

![]()

-

08

Rakuten Pay

Rakuten who operates e-commerce shopping operates this Rakuten Pay. Customers will need to register as a Rakuten member and download Rakuten Pay smartphone app to use this service. This app allows Rakuten members to easily link the credit cards registered on their Rakuten account to make payments via the app. By using this service, customers can earn Rakuten reward points, and if they also have a Rakuten credit card, the points become doubled. These reward points can be used for shopping at the rakuten affiliated shops. Customers have several ways to make payment using this app; scan the QR code, display the code for the shop assistant to scan, or self method where the customers choose the shop and key in the amount to be paid.

![]()

-

09

Mobile Carriers Payment

While this is limited to those registered with Japanese mobile carriers like DoCoMo and Au, both carriers offer their unique payment services like dBarai (DoCoMo) and auPay (Au) which are billed together with the monthly mobile phone bill. There are limits to the amount that can be used which are based on the customer's payment history (ex. no delay in monthly payment means higher limits). Compared to other forms of cashless payments, these aren’t widespread in Japan.

READ MORE- Money in Japan: Banknotes and Coins

-

![]()

- Need to Know

- RAYARD MIYASHITA PARK(レイヤードミヤシタパーク)

-

-

- 東京都渋谷区神宮前6-20-10

-

View All